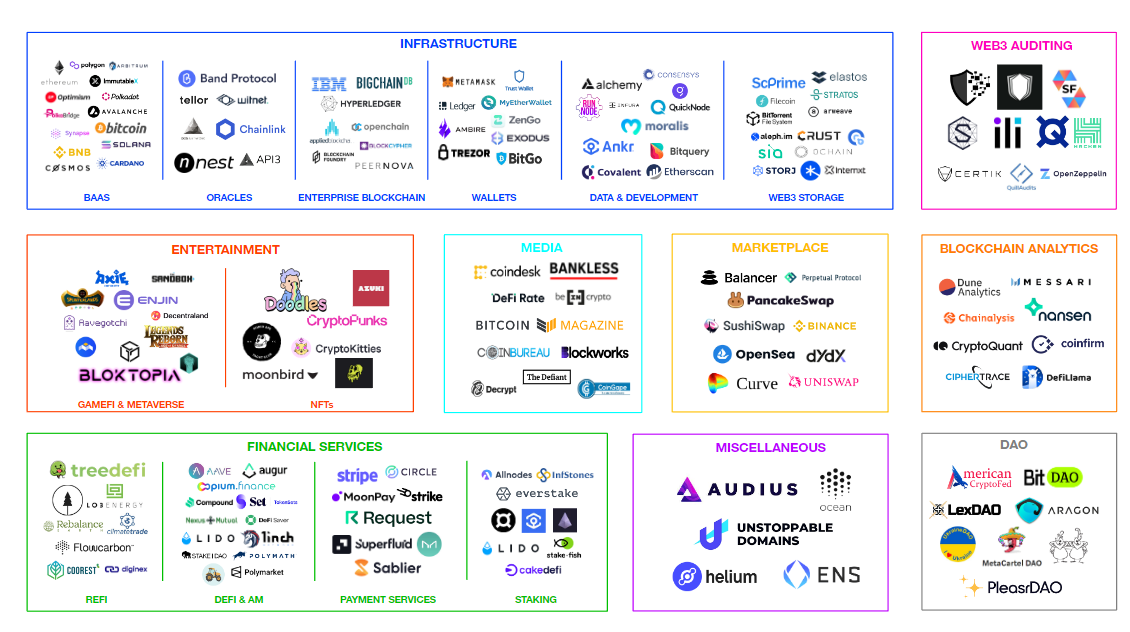

A Deep Dive into the Roles and Value Added of Key Players

Blockchain key players

Blockchain as a Service (BaaS)

BaaS providers offer blockchain infrastructure for various applications, allowing businesses to use blockchain technology without the need to develop their own blockchain. It includes smart contract functionality and interoperability solutions.

Business Model: Blockchains selling blockspace and smart contract functionalities.

Key Metrics: Active developers, Monthly Active Users (MAU), Total Value Locked (TVL) for smart contracts, network transactions, number of nodes, Transactions Per Second (TPS), Network Value to Transactions (NVT) ratio, and economic network security.

Wallets

Wallets store, send, and receive cryptocurrencies and tokens. Non-custodial wallets give users full control of their keys, while custodial wallets are managed by third parties. They may also offer additional services like crypto purchases or exchanges.

Business Model: Non-custodial and custodial wallets offering various services.

Key Metrics: Downloads/purchases, MAU, and number of partnerships.

Enterprise Blockchain Solutions

These solutions are tailored for business use, improving efficiency, transparency, and security in transactions between organizations. They often focus on specific industries like supply chain or finance and include consortia blockchains.

Business Model: Secure, efficient business transactions and collaborations.

Key Metrics: Booking Value, Annual Contract Value (ACV), and number of industries served.

Oracles

Oracles bridge the gap between blockchains and external data, allowing smart contracts to execute based on real-world information. Decentralized oracle networks ensure data accuracy and reliability for blockchain applications.

Business Model: Data feed for smart contracts from off-chain sources.

Key Metrics: Fees generated, number of nodes, and APIs connected.

Data & Development

This encompasses tools and services that support the development and operation of blockchain-based applications, including APIs, SDKs, blockchain explorers, and node services. They facilitate access to blockchain data and infrastructure.

Business Model: Backend services for Web3, like indexing and blockchain explorers.

Key Metrics: User retention, Monthly/Annual Recurring Revenue, Customer Acquisition Cost (CAC), and growth rate.

Web3 Storage

Decentralized storage solutions offer a secure and distributed way to store data, challenging traditional cloud storage providers. They use blockchain technology to ensure data integrity and availability.

Business Model: Decentralized data storage solutions.

Key Metrics: Consensus mechanism strength, total data stored, storage cost per unit, and hardware costs.

Financial Services: ReFi and DeFi

Regenerative Finance (ReFi) focuses on sustainable and environmentally friendly financial practices, while Decentralized Finance (DeFi) offers a broad spectrum of financial services without central intermediaries, from lending and borrowing to asset management.

Business Model: Regenerative Finance and decentralized financial services.

Key Metrics: Booking Value, ACV, project audits, and in DeFi, metrics include TVL, active developers, audits, MAU, and transaction volume.

Payment Services

These services facilitate transactions between fiat and cryptocurrencies, aiming to offer faster, cheaper, and more accessible payment solutions than traditional systems. They support a wide range of currencies and integrate with various platforms.

Business Model: Bridging fiat and cryptocurrency payments.

Key Metrics: Number of customers, cryptocurrencies accepted, Gross Transaction Value (GTV), Net Revenue, user retention, and Customer Acquisition Cost (CAC).

Staking as a Service (StaaS)

StaaS platforms enable users to participate in network consensus mechanisms, like Proof of Stake, by pooling their tokens to earn staking rewards. It simplifies the process for individuals to contribute to network security and earn passive income.

Business Model: PoS consensus mechanism-based staking pools.

Key Metrics: Cryptocurrencies accepted, Gross Deposit Value (GDV), Net Revenue, and user retention.

Entertainment: GameFi & Metaverse

GameFi combines gaming with financial mechanisms, rewarding players with real value, while the Metaverse offers virtual environments for socializing, commerce, and entertainment. Both rely on blockchain technology for ownership and transactions.

Business Model: Gaming and virtual worlds on the blockchain.

Key Metrics: Daily Unique Visitors (DUV), growth rate, in-game purchases, and value of digital assets.

NFTs

Non-fungible tokens represent ownership of unique digital items, from art and collectibles to in-game assets. They utilize blockchain technology for verifiable scarcity and provenance of digital content.

Business Model: Non-fungible tokens for digital scarcity and traceability.

Key Metrics: Number of sales, volume of sales, and community engagement.

Media

Web3 media platforms provide news, analysis, and educational content on blockchain technology and the digital asset industry. They monetize through advertisements, subscriptions, and sponsorships.

Business Model: Web3 news and educational content.

Key Metrics: MAU, paid users, subscriber retention, sponsorships, CAC, and community size.

Auditing / Web3 Security

These services focus on ensuring the security and integrity of blockchain applications by auditing smart contracts and validating liquidity reserves. They play a crucial role in maintaining trust in decentralized platforms.

Business Model: Smart contract and liquidity reserve audits.

Key Metrics: Number of developers, projects audited, growth rate, and compromised projects.

Marketplace

Marketplaces in the Web3 space facilitate the buying and selling of cryptocurrencies, digital collectibles, and other assets. They can be centralized, with a single entity managing the platform, or decentralized, enabling peer-to-peer transactions without intermediaries.

Business Model: Platforms for trading cryptocurrencies and digital collectibles.

Key Metrics: Trade volume, Net Revenue, growth rate, and user retention.

This summary of the blockchain key players encapsulates the vast landscape of Web3 business models, highlighting the significance of specific metrics for evaluating the success and sustainability of these models.