The media landscape is undergoing rapid evolution, shaped by globalization and audience fragmentation. Traditional media, bolstered by digital precision marketing, plays a pivotal role in brand development and business growth:

– Media plans have the ability to reach a wide audience and build mass awareness. This broad reach is crucial for FMCG products that target a diverse consumer base. About Marketing growth article

– Advertising can significantly influence consumer purchase decisions especially for impulse purchases and brand-switching behavior.

– Repetitive exposure to brand messaging through media can drive brand recall and consideration at the point of purchase as well as building strong brand identity and differentiate themselves from competitors.

In summary, until today, media channels play a vital role in driving brand awareness, influencing purchase decisions, and establishing brand positioning for FMCG brands.

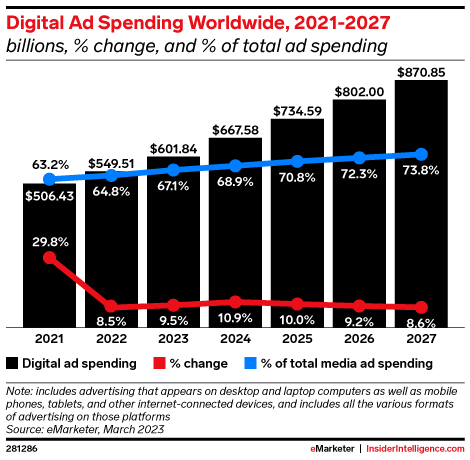

Though, we are facing a new transformation of media, and an accelerated shift toward digital, generating new challenges, and less and less relying on traditional media.

However, the media landscape is transforming, shifting swiftly towards digital and reducing reliance on traditional media.

Why? The evolution of consumer consumption patterns shows a rapid decline in linear TV viewership as audiences move towards streaming platforms. Brands are increasingly demanding immediate and precise returns on their advertising spend.

Key challenges for brands:

1. Globalization: The Shift from Local to Global Media

The rise of digital platforms has fundamentally altered the media industry, pushing it from local markets to a global stage.

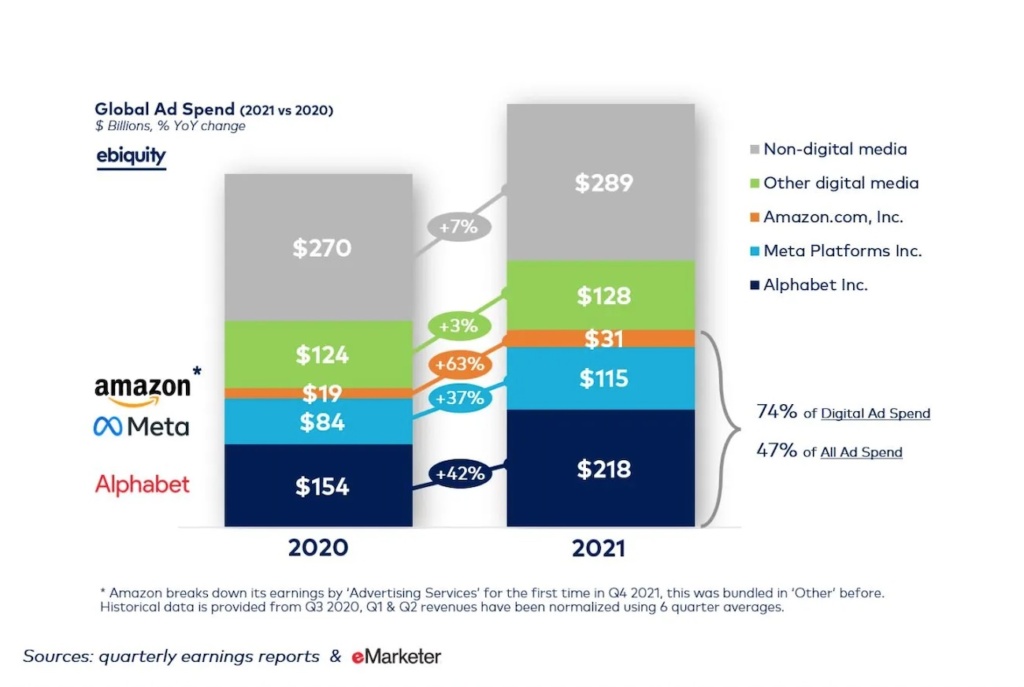

3 global Tech giants Google, Meta, and Amazon are attracting most of these digital investments. And this share is growing Quarter over Quarter. These platforms leverage cutting-edge technology to serve targeted advertisements and content, reaching audiences across different regions with unprecedented precision.

Digital tools such as Demand-Side Platforms (DSPs) and Ad Verification systems operate on a global scale, enabling advertisers to optimize their campaigns in real-time and across borders.

Share of Google, Meta and Amazon in digital advertising (evolution)

Google, Meta and Amazon are absorbing more than 50% of all ad money

In short, the only significantly and systematically growing segment in advertising is: Digital Advertising on leading platforms, which is by essence global.

The weight of local media players (ie: National TV channels) is decreasing. Media planning shift is accelerating from a highly localized activity (local TV and press) into a more globalized activity.

And this has a significant impact on brands and agencies.

2. Audience Fragmentation: The Push to Close the Media Loop

In an era where every dollar spent needs to justify itself, advertisers are increasingly focused on closing the media loop.

This concept involves creating a direct link between media expenditure and business results.

The advent of retail media networks exemplifies this trend, wherein brands can directly influence consumer behavior at the point of purchase.

By integrating media channels with retail environments, companies can track the immediate impact of their advertising, from exposure to conversion.

This approach is particularly visible in online retail, where e-commerce platforms use sophisticated data analytics to show advertisers exactly how their spending translates to sales.

This granular level of detail goes beyond traditional metrics like impressions or clicks, providing deep insights into consumer behavior and campaign effectiveness.

This trend is evolving beyond retail, as banks like JPMorgan Chase launched a new digital media business called Chase Media Solutions that allows advertisers to directly target the bank’s 80 million customers based on their spending data and purchase history. The platform combines the scale of a retail media network with Chase’s exclusive transaction data, enabling brands and agencies to precisely target customers at scale, such as new, lapsed, or loyal customers.

3. Audience Fragmentation: From linear to addressable TV

Traditional broadcast television is facing a significant challenge from streaming services like Amazon Prime Video, Disney+, and Netflix.

These platforms have reshaped the entertainment landscape by offering on-demand content tailored to individual tastes and preferences.

According to Nielsen data, linear TV (broadcast and cable combined) accounted for less than 50% of total TV viewing time in July 2023 for the first time, dropping to 49.6%.

In contrast, streaming viewership reached a record 38.7% share in July 2023, driven by platforms like YouTube, Netflix, and Amazon Prime Video.

The decline in linear TV viewership is even more pronounced among younger generations, with kids’ programming on linear TV collapsing by 53% from 2019 to 2021.

The ability of these services to aggregate detailed viewer data allows for more targeted advertising, making them highly attractive to modern marketers.

This shift of consumer behavior is also happening in radio with the surge of Podcasts or on-demand music, as well as in out of home with DOOH offering dynamic content that can be updated in real time.

Marketers are also shifting toward addressable TV, with a very compelling value proposition: The convergence of branding and performance marketing.

Digital platforms offer continuous targeting and measurement capabilities, allowing for campaigns that not only build brand awareness but also drive sales in the immediate term.

This blending of objectives helps advertisers maximize their ROI by aligning brand-oriented content with performance-driven tactics.

Amazon’s advertising business saw impressive growth in the first quarter of 2024, with revenue jumping 24% year-over-year to $11.8 billion.

This strong performance was driven by the growth of Amazon’s core e-commerce and Prime Video streaming businesses

Amazon introduced unskippable ads on its Prime Video service this year, allowing customers to opt-out for a $2.99 monthly fee. This move has attracted new advertisers and contributed to the ad revenue growth.

The company’s advertising efforts continue to benefit from the expansion of its online stores and Prime Video platforms, which provide more opportunities for sponsored product ads and video ads.

Amazon CEO Andy Jassy expressed optimism about the company’s advertising business, stating, “It’s very early days in all of our businesses, and we remain excited by how much more we can make customers’ lives better and easier moving forward.”

The company expects its advertising arm to continue benefiting from the growth of its e-commerce and streaming platforms, providing more opportunities for targeted advertising.

Overall, Amazon’s advertising segment has emerged as a significant revenue and profit driver, complementing the company’s core businesses and positioning it as a key player in the digital advertising landscape.

4. Globalization and Audience Fragmentation: How brands should adapt?

There is no one answer, obviously the solution depends on the brand, but here are a few thoughts … please share yours :

- A pragmatic approach to globalization: Centralize operations where possible to win in terms of effectiveness while staying close to local consumers.

- Brand needs reach and scale to grow and it comes before engagement performance

- Focus on qualitative activations concerning brand safety and consumer attention.

- Experiment at scale with a defined process and clear objectives

- Pick your battle, more than 200 Retail media Networks exist, no one can test so many options…

- Engage on the long term with selected walled gardens to build a competitive advantage (data, knowledge…).

As the media continues to evolve under the pressures of globalization and fragmentation, opportunities and challenges abound.

To thrive, businesses must be agile, willing to innovate, and ready to adapt to the new realities of a digital, global marketplace.